Are Medical Bills Dischargeable in Bankruptcy?

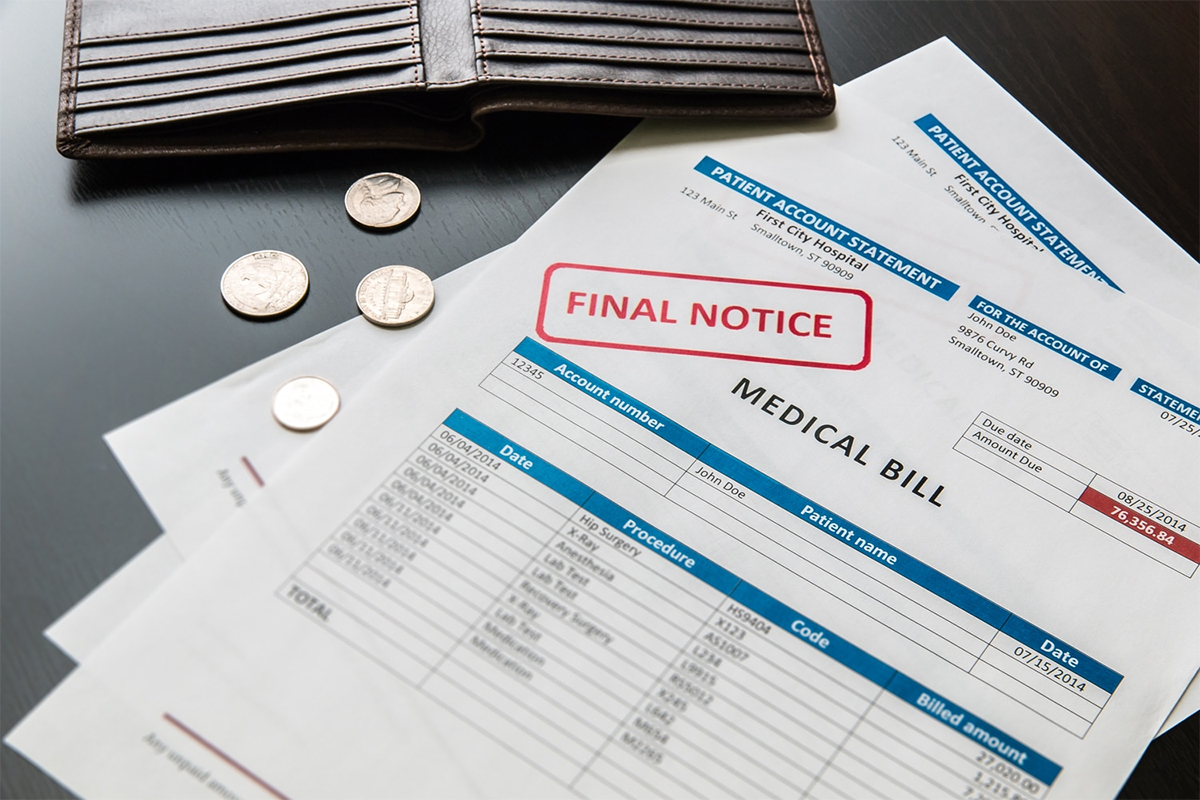

In the United States, medical bills are considered unsecured debts, much like credit card debt or personal loans. This means that they can typically be discharged in a Chapter 7 bankruptcy, which allows individuals to eliminate certain types of debt and get a fresh start. The process of discharging medical bills in bankruptcy is not always straightforward and there are several factors to consider.

When filing for bankruptcy, individuals must meet certain eligibility requirements and adhere to the rules set forth in the Bankruptcy Code. In some cases, a debtor’s income and assets may be evaluated to determine if they qualify for Chapter 7 bankruptcy, or if they will be required to file for Chapter 13 bankruptcy, which involves creating a repayment plan to satisfy creditors.

Certain types of medical debt may not be dischargeable in bankruptcy. If a debtor incurs medical bills shortly before filing for bankruptcy, those debts may not be eligible for discharge. There are also limitations on the amount of medical debt that can be discharged, as well as potential challenges from creditors who may try to argue that certain medical expenses should not be discharged.

Chapter 7 Bankruptcy and Medical Debt

Chapter 7 bankruptcy, also known as “liquidation” bankruptcy, allows individuals to discharge most of their unsecured debts, including medical bills. This type of bankruptcy typically lasts for about three to six months and requires the debtor to liquidate their nonexempt assets to repay creditors. However, many individuals are able to retain their essential assets, such as their home and car, through exemptions provided by state law. [1]

Filing for Chapter 7 bankruptcy can provide individuals with a fresh start by eliminating medical debt and stopping creditor harassment. Once the bankruptcy process is complete, the individual is no longer responsible for paying off their medical bills, and creditors are prohibited from attempting to collect on discharged debts.

To qualify for Chapter 7 bankruptcy, individuals must pass a means test, which assesses their income and expenses to determine if they have the financial means to repay their debts. Individuals may be required to undergo credit counseling before filing for bankruptcy.

Chapter 13 Bankruptcy and Medical Debt

Chapter 13 bankruptcy allows people to reorganize their debts and create a plan to repay creditors over a period of three to five years. This type of bankruptcy can be a helpful option for those struggling with overwhelming medical bills.

Medical debt is a common reason to consider filing for Chapter 13 bankruptcy. High costs of medical care and unexpected medical emergencies can quickly lead to significant debt that becomes difficult to manage. Filing Chapter 13 can provide relief from this burden.

When filing for Chapter 13 bankruptcy, individuals work with a bankruptcy trustee and their creditors to create a repayment plan. This plan takes into account income and expenses to determine a manageable monthly payment. Chapter 13 allows property and assets to be retained while the person makes payments through a repayment plan.

One of the key benefits of filing for Chapter 13 bankruptcy to relieve medical debt is that it can stop collection efforts, wage garnishments, and harassment from creditors. This can provide much-needed relief for individuals who may feel overwhelmed by not only their medical bills but also the relentless pursuit of collectors.

Alternative Ways to Reduce or Pay Off Your Medical Bills

One option to consider is negotiating with healthcare providers for a lower bill. Many medical providers are willing to work with patients to create a payment plan or reduce the total amount owed. It is important to be open and honest about financial situations and to provide documentation if necessary to support a request for a reduced bill. [2]

Another alternative is to explore charity care programs offered by hospitals and clinics. These programs are designed to assist low-income individuals who are struggling to pay for their medical expenses. Eligibility requirements vary by facility, but it is worth inquiring about these programs as they can potentially provide significant relief from medical debt.

Some individuals may be eligible for financial assistance through government programs such as Medicaid or Medicare. These programs are designed to provide healthcare coverage to low-income individuals and can help alleviate the burden of medical bills.

Contact Frego Law bankruptcy attorneys today to schedule a consultation and find out if filing bankruptcy on your medical bills is the right path for you.

FAQs

When you file for bankruptcy, it is reflected on your credit report for several years. This can make it more difficult to obtain new lines of credit or loans in the future. It can also result in higher interest rates and less favorable terms for any credit that is approved.

Chapter 7 bankruptcy, which is the most common type of bankruptcy filed for medical debt, stays on your credit report for 10 years, while Chapter 13 bankruptcy, which involves a repayment plan, stays on your credit report for 7 years.

While most medical bills can be discharged, certain debts, such as those related to recent luxury medical treatments or incurred through fraudulent means, may have restrictions on discharge.

It is generally advisable to include all debts, including medical bills, when filing for bankruptcy to ensure comprehensive debt relief. However, consulting with a bankruptcy attorney can provide guidance based on your specific situation.

Yes, filing for bankruptcy can have a negative impact on your credit score. However, it also provides an opportunity for a fresh financial start, and individuals can take steps to rebuild their credit over time.

Sources:

[1] Brady, S. (2023, June 6). Can a medical bankruptcy get you out of debt? Intuit Credit Karma. https://www.creditkarma.com/advice/i/medical-debt-in-bankruptcies

[2] Henricks, M. (2023, May 9). Medical Bankruptcies: Can You File For Bankruptcy Over Medical Bills? Forbes Advisor. https://www.forbes.com/advisor/debt-relief/medical-bankruptcies/